Thinking about owning a place of your own? For many, having a home is a big dream, a comfortable spot to make memories and build a future. It’s a significant step, perhaps the biggest purchase you might make in your whole life, and getting ready for it means gathering all the right information. You want to feel good about every choice you make along the way, right?

Making that move from dreaming to doing can seem like a lot to take on, what with all the different things to think about. There's finding the right place, figuring out how to pay for it, actually buying it, and then keeping it in good shape. It's a whole series of financial decisions, more or less, that can feel pretty involved for anyone just starting out or even for those who have thought about it for a while. So, getting some good guidance can make all the difference.

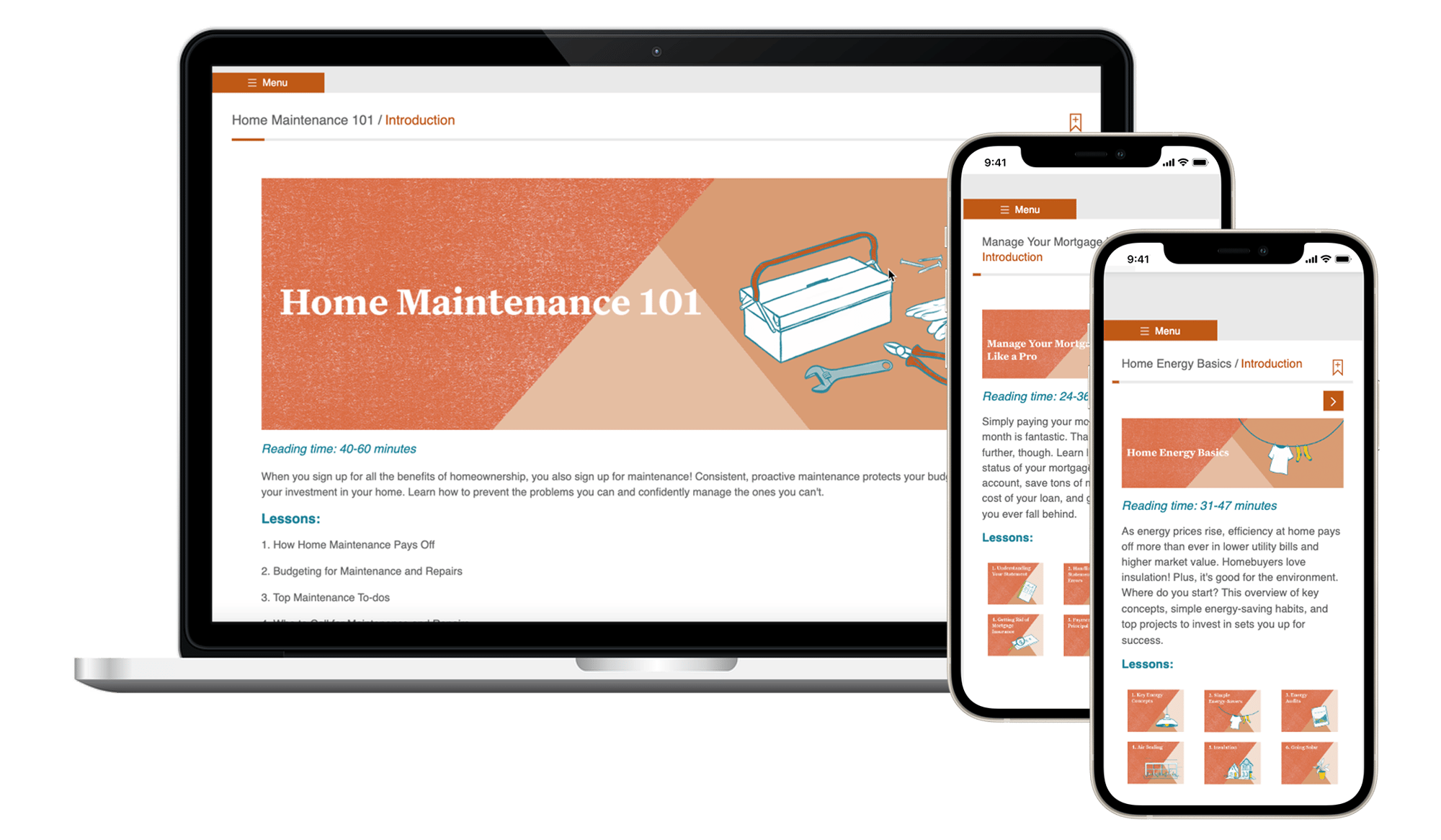

That's where a bit of learning comes in handy. Imagine having a clear path laid out for you, showing you what to expect and how to handle each part of getting a home. A homeownership education course, like one you might find through a chase for knowledge, helps you prepare for what’s ahead. It’s about getting ready, so you feel confident and ready to take on this exciting part of your life, actually.

Table of Contents

- Why Think About a Home?

- What Makes Buying a Home Feel So Big?

- How Can Homeownership Education Course Chase Help?

- Support for Homeownership

- Who Can Get Help with a Homeownership Education Course Chase?

- Preparing for Your Homeownership Education Course Chase

- The Big Picture of Homeownership

- A Look at the Bigger Economic Picture

Why Think About a Home?

Owning a home represents a really big personal achievement for many folks. It's a place where you can put down roots, create a sense of belonging, and truly make a space your own. For some, it’s about having a stable place for their family; for others, it's about building something for the future. It’s a very significant financial step, too, perhaps the single largest one you will ever make in your life. So, it makes sense to approach it with some thought, doesn't it?

The idea of having your own house, a yard, or even just a quiet apartment that belongs to you, holds a lot of appeal. It gives you a certain kind of freedom to decorate as you wish, to change things up, or just to enjoy a quiet evening without worrying about a landlord. It’s about creating a personal sanctuary, a place that feels completely like yours, which is a big part of why people chase this dream, you know.

This big purchase also comes with a lot of considerations. You have to think about where you want to live, what kind of house fits your needs, and what you can truly afford. It's not just about the upfront cost, but also about the ongoing expenses that come with keeping a home. So, it's a decision that touches many parts of your life, actually, and it's good to feel prepared for all of it.

What Makes Buying a Home Feel So Big?

Getting a home involves a lot of different pieces that all need to fit together, which can make it feel a bit overwhelming at times. There's the whole process of finding a house you like, then figuring out how to pay for it, which usually means getting a loan. After that, you actually purchase the place, and the work doesn't stop there. You then need to take care of it, maybe even make some improvements, and later on, you might think about getting a different loan or even selling it.

Each of these steps has its own set of details and paperwork. The money side of things, for example, can feel particularly involved. You might hear terms like interest rates, closing costs, and property taxes, which are all important to grasp. It's a complicated financial picture, truly, and it’s completely normal to feel like you need some help making sense of it all. This is where a good homeownership education course can really make a difference, you know.

Without some guidance, it’s easy to feel a little lost in all the information. You want to be sure you are making choices that are good for you and your family, both now and in the future. Knowing the steps, understanding the costs, and seeing what support is out there can make the whole thing feel much more manageable. It’s about feeling ready for what’s ahead, which is why people look for a homeownership education course chase, actually.

How Can Homeownership Education Course Chase Help?

A good homeownership education course helps you get ready for the entire process of buying and owning a home. It's like having a helpful friend explain everything in a clear way, so you don't feel confused. These courses often cover the good points and the less good points of owning a house, helping you think through everything before you make any big choices. You can also read a homeownership guide, which provides helpful information, too.

Such a course provides a clearer picture of what's involved in buying a house. It helps you understand the steps from beginning to end, so you know what to expect at each turn. This kind of preparation can really help reduce any worries you might have about such a big decision. It's about giving you the tools to make smart choices, which is pretty important, really.

When you go through a homeownership education course, you learn about different types of loans, what kind of paperwork you'll see, and how to work with real estate people and lenders. It's all about making sure you feel well-informed and ready to move forward with confidence. It's a way to chase after the knowledge you need to be a successful homeowner, in a way.

Support for Homeownership

There are many groups and programs set up to help people achieve their dream of owning a home, especially for those who might need a bit of extra help. These homeowner assistance programs offer different kinds of support, from information and resources to direct aid. For example, some non-profit services, like those offered by CDLI in Long Island, work to empower people's homeownership dreams. They provide affordable rentals, education about homeownership, and even resources for those who develop homes and properties, which is really helpful, you know.

One very important program is the Housing Choice Voucher (HCV) program, sometimes called Section 8. This program helps households with lower incomes in places like New York State rent or even buy decent, safe places to live in the regular housing market. It's a way to open up possibilities for people who might otherwise find it hard to afford a home. So, it's a big help for many families, actually.

Officials, like Ruthanne Visnauskas, who was appointed commissioner of New York's housing agency in 2017, work to oversee these kinds of programs and make sure they run well. Their goal is to help more people get into homes they can afford. This kind of support means that the path to homeownership, even with a homeownership education course chase, is not something you have to do all by yourself. There are resources out there to assist you, which is pretty reassuring.

Who Can Get Help with a Homeownership Education Course Chase?

The homeownership program often works with people who are already part of the Housing Choice Voucher (HCV) program. This means if you are already receiving help with your rent through HCV, you might be able to use that assistance to buy a home instead. It’s a very helpful option for families who want to make that step from renting to owning, you know.

To be able to join the homeownership program, you typically need to have a low income. This rule helps make sure that the program helps those who need it most. The HCV homeownership program allows families who are getting help under the HCV program to use their vouchers for homeownership costs, which is a pretty big deal for many people, really.

So, if you meet the income requirements and are already connected with the HCV program, looking into a homeownership education course chase could be your next smart move. These courses can help you understand how to use your existing benefits to become a homeowner. It's about taking advantage of the support that's available to you, which is a very good idea.

Preparing for Your Homeownership Education Course Chase

Before you even start house hunting, or if you just want to make sure you're using all the opportunities homeownership offers, it's a good idea to check out lists of helpful tips. These lists can give you some inspiration and practical steps to consider. They help you think through the process and decide if buying a house is the right choice for you at this time. It's about getting all your ducks in a row, so to speak, before you make a big decision, basically.

A homeownership education course, as part of your chase for knowledge, will often cover many of these practical points. It might go over what kind of credit you need, how much money you should save, and what to look for when you are walking through houses. It’s about getting ready for the practical parts of buying a place, which can feel quite involved, actually.

Taking the time to prepare yourself with this kind of learning can save you a lot of trouble later on. It helps you avoid common mistakes and feel more in control of the whole process. So, before you sign any papers or even start seriously looking, consider getting some education. It's a very smart way to approach such a significant purchase, too.

The Big Picture of Homeownership

Organizations like Fannie Mae play a part in making sure that people have access to housing that they can afford and keep up with. This work helps both those who want to buy a home and those who rent. It's a big reason why such organizations exist, to help create a more stable housing market for everyone. They work behind the scenes to make sure the system works, in some respects.

Homeownership, as we've talked about, is likely one of the largest purchases you will ever make. It involves finding a place, figuring out the money side, actually buying it, taking care of it, maybe getting a new loan later, and perhaps even selling it. These are all parts of a complicated financial process, and it's good to have some help understanding them, you know.

So, when you consider a homeownership education course, you're not just learning about your own personal steps. You're also getting a sense of the larger system that supports home buying. It helps you see how different pieces fit together, from government programs to big housing organizations, all working to help people get into homes. It’s a pretty helpful way to approach such a big life event, actually.

A Look at the Bigger Economic Picture

The broader economy, especially how money is managed by big banks and how governments handle their spending, can affect things like prices. For example, when there's a big change in how money is handled, it can lead to prices going up, a situation sometimes called inflation. These sorts of changes can influence the cost of homes and the rates on loans, which is something to keep in mind, too.

Experts often look at how different money policies affect prices and how much stuff the economy produces. They try to figure out if certain actions by central banks, like making money easier or harder to get, will cause prices to change. It's a complex area, but it shows that what happens with the larger money system can have an effect on everyday things, like buying a home, you know.

The success of efforts to keep prices stable often depends on how money policies and government spending plans work together. If investors, the people who put money into things, expect prices to change a lot, it can create a ripple effect. This means that even though a homeownership education course chase focuses on your personal steps, it's also helpful to have a general idea of how the bigger money picture can play a role, actually.

Related Resources:

Detail Author:

- Name : Linnea Grant Sr.

- Username : lilliana57

- Email : isaias.okuneva@barton.com

- Birthdate : 1979-08-21

- Address : 33560 Autumn Oval Apt. 036 South Isabellefurt, MS 56898

- Phone : 949-359-6866

- Company : Gislason LLC

- Job : Diagnostic Medical Sonographer

- Bio : Quia alias quis enim. Eligendi ex fugiat quia dolore et quas tempora. Voluptatibus illum voluptatem nihil. Fuga repellat fugiat aut voluptatem aut.

Socials

instagram:

- url : https://instagram.com/herzog1999

- username : herzog1999

- bio : Maxime sed odit in possimus. Voluptatem dolores beatae debitis at.

- followers : 1600

- following : 195

linkedin:

- url : https://linkedin.com/in/herzog1976

- username : herzog1976

- bio : Nihil enim laudantium inventore.

- followers : 3667

- following : 814

twitter:

- url : https://twitter.com/holden.herzog

- username : holden.herzog

- bio : Neque qui laborum et et. Qui impedit cum deleniti. Expedita autem fuga quis vel labore enim. Consequatur et quaerat nemo aut officiis.

- followers : 5551

- following : 2131

facebook:

- url : https://facebook.com/hherzog

- username : hherzog

- bio : Rerum dolores recusandae inventore magni fuga possimus sunt.

- followers : 3896

- following : 1099