Figuring out what credit card can I get can feel like a bit of a puzzle, can't it? Many people wonder about this, as they look for ways to handle their money better and maybe even see it grow. It's really about getting a clear picture of your own money story, so you can make choices that help you move forward financially. This way, you can pick out a card that fits just right with your current situation and your plans for the future, helping you reach your financial aims.

You see, there is quite a lot of talk about credit these days – things like credit summaries, credit numbers, credit holds, and also keeping an eye on your credit. It's pretty common to hear these phrases, and sometimes, you might just wonder what all of it means for you personally. Knowing what these terms mean is a big step toward understanding what credit card can I get, because your past actions with money really do tell a story about you to lenders, you know?

This whole idea of credit, basically, is an arrangement where someone gets something right away and promises to pay for it later, often with a little extra amount added on. It is a promise, a commitment that you will pay back what you owe. This promise, in turn, helps others decide if they want to lend you money, or let you use a credit card. So, getting a handle on your credit story is a good place to begin when you are thinking about what credit card can I get.

- Destiny 2 Server

- How Often To Use Cetaphil

- Does Walmart Accept American Express

- Kaymbu Login

- Mahomes Parents

Table of Contents

- What Does Your Credit Picture Show You?

- How Can Checking Your Credit Help You Find What Credit Card Can I Get?

- Getting a Clear View of Your Credit Standing

- What is Credit, and What Credit Card Can I Get With It?

- Protecting Your Money Story

- Where Can You Look For What Credit Card Can I Get Information?

- Tools to Help You Move Forward

What Does Your Credit Picture Show You?

When you are thinking about what credit card can I get, it is pretty helpful to consider what your current financial standing looks like. There are some really useful resources available, like the ideas and ways of looking at things from Intuit Credit Karma. These services offer suggestions and tools that can help you handle your money in a better way and perhaps even make it increase more quickly. This support is all about helping you move ahead with your finances, so you can reach your money goals, which is actually quite important.

These kinds of suggestions are often based on your personal money history, giving you a sort of map to follow. They can point out areas where you are doing well, and also spots where you might want to make some changes. For example, if you have been good about paying bills on time, that is a positive sign. If you have had some late payments, those services might suggest ways to get back on track. All of this information helps you understand your financial health, which is a big part of figuring out what credit card can I get that fits your situation.

The tools provided by these services are designed to give you a clearer view of your money habits. They might show you how much debt you have, or how much of your available credit you are using. Knowing these things can help you make smarter decisions about applying for a new card. You see, when you apply for a credit card, the companies offering them look at these very details. So, having a good grasp of your own money picture is a really good first step when you are asking, "what credit card can I get?"

- Asher Grodman Sexuality

- Chase First Time Home Buyer

- James Taylor Kinderen

- State Of Colorado 1099 G

- Hotel In San Ramon Ca

How Can Checking Your Credit Help You Find What Credit Card Can I Get?

A big part of understanding what credit card can I get involves keeping a watchful eye on your credit standing. This means making sure your identity is safe and also staying on top of your credit details. It is a bit like keeping track of your health; you want to know if everything is in good order. If there are any strange activities or things that do not look right, you want to catch them quickly. This helps you avoid bigger problems later on, which is pretty useful.

Protecting your identity is a serious matter, especially when it comes to your financial life. If someone else gets hold of your personal information, they could try to open accounts in your name, which could mess up your credit story. By regularly checking your credit, you can spot any unauthorized accounts or unusual charges. This proactive approach helps keep your financial information secure, allowing you to feel more confident when you consider what credit card can I get.

Staying on top of your credit also means knowing where you stand. Is your credit history looking strong, or does it need some work? Are there any old errors that might be holding you back? Services that help you monitor your credit can send you alerts if something changes, like a new account being opened or a big drop in your credit score. These alerts give you a chance to act fast. So, keeping a close watch on your credit is a key part of the process when you are trying to figure out what credit card can I get, because it helps you present the best version of your financial self.

Getting a Clear View of Your Credit Standing

Experian, for instance, is one of the companies that works to help people keep their credit safe, understand it better, and also make it stronger. They are pretty dedicated to this work, offering tools and resources that can really make a difference. It is a bit like having a guide who shows you the way through your financial information, helping you see what is what. This kind of support is very helpful when you are trying to answer the question, "what credit card can I get?"

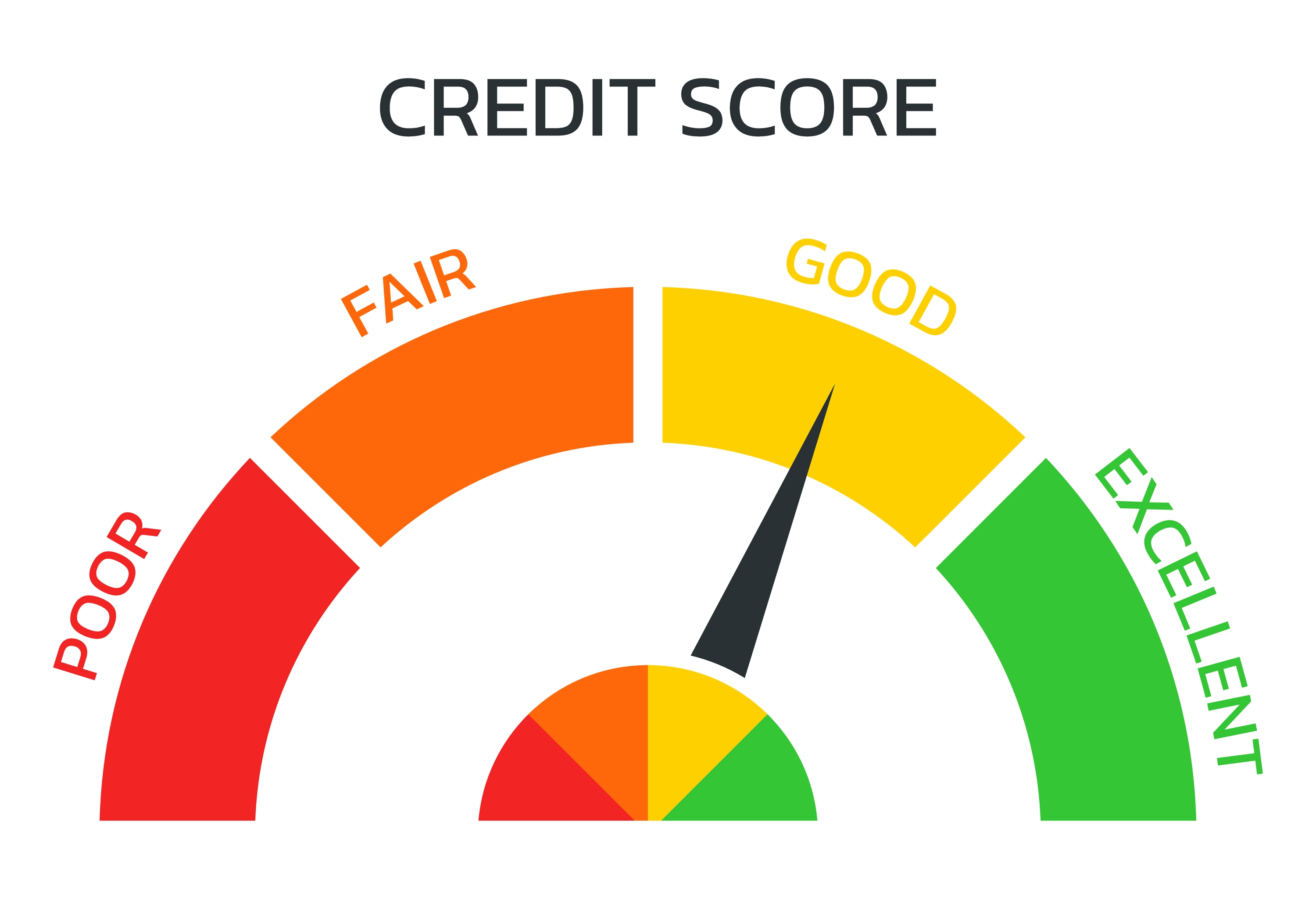

A good starting point for many people is to get their free Experian credit summary and their FICO® score. This is a bit like getting a report card for your credit. It shows you what information lenders see when they look at your financial history. Your FICO score is a number that gives a quick idea of how well you handle your money. A higher score generally means you are seen as less of a risk, which can open up more options for what credit card can I get.

When you have this report and score, you can then log in securely to manage your credit information. Websites like Credit.com allow you to keep an eye on your score and get access to personalized financial tools. These tools can help you see what areas of your credit might need attention. They can also give you ideas on how to improve your score, which, in turn, can change the types of credit cards you might be able to get. So, really, getting this clear view is a fundamental step for anyone asking, "what credit card can I get?"

What is Credit, and What Credit Card Can I Get With It?

To really get a handle on what credit card can I get, it helps to know what credit actually is. At its core, credit is a kind of promise, a formal arrangement where someone receives something of value right away. This could be money, or it could be a product or service. The understanding is that they agree to pay for it later, usually with an extra amount added on, which we call interest. It is a system built on trust and the expectation of future payment, in a way.

Think of it like this: when you use a credit card, you are essentially borrowing money from the card issuer to buy something. You do not pay for it immediately with money from your bank account. Instead, you are given a short-term loan. The credit card company trusts that you will pay back that loan, plus any interest, by a certain date. This is the basic idea that makes credit cards work. So, the kind of credit card you can get depends a lot on how much trust lenders are willing to place in you, based on your history of keeping these kinds of promises.

Your history of paying back what you borrow builds your credit story. If you consistently pay on time and manage your debts well, your credit story becomes stronger. This stronger story can lead to better options when you are looking for what credit card can I get. It might mean cards with lower interest rates, higher spending limits, or even special rewards. Conversely, if you have a history of late payments or not paying back what you owe, your options might be more limited, and the terms might be less favorable. It is all about that promise and how well you keep it.

Protecting Your Money Story

Keeping a close watch on your credit story is a pretty important part of your money life. It is not just about getting a new card; it is about keeping your overall financial health in good shape. Because of this, it is a good idea to check your credit summaries often. There are even free weekly online credit summaries available from the three main companies that keep track of this information: Equifax, Experian, and TransUnion. This access makes it easier to stay informed, which is really quite useful.

These credit summaries contain a lot of information about your past financial actions. They list your accounts, how much you owe, and your payment history. They also show if you have had any issues, like late payments or accounts that went to collections. By reviewing these summaries regularly, you can make sure all the information is correct. Sometimes, mistakes can happen, and those errors could make it harder for you to get what credit card can I get, or even impact other financial dealings.

Making a habit of checking these summaries can also help you spot signs of identity theft. If you see an account listed that you did not open, or a loan you did not take out, that is a big red flag. Catching these things early can save you a lot of trouble and stress down the road. So, thinking about your credit reports as a regular check-up for your financial identity can be a helpful way to approach them. This consistent checking helps you keep your money story accurate and healthy, which is a big piece of the puzzle when you are considering what credit card can I get.

Where Can You Look For What Credit Card Can I Get Information?

When you are trying to figure out what credit card can I get, knowing where to find reliable information is quite key. As mentioned, the three main credit reporting companies – Equifax, Experian, and TransUnion – are the primary sources for your credit summaries. These summaries are the detailed records of your borrowing and repayment history. They are what lenders look at when they decide whether to approve you for a credit card, and what terms they will offer you, too.

It is worth noting that you are entitled to a free copy of your credit summary from each of these companies once a week through AnnualCreditReport.com. This means you can get a fresh look at your credit picture quite often, which is a pretty big advantage. By checking each of them, you can compare the information and make sure there are no differences or errors across the board. This kind of thoroughness helps you present the most accurate picture of your financial standing when you are applying for a card, which is something you should consider.

Beyond the credit reporting companies themselves, there are also services like Intuit Credit Karma and Credit.com that pull information from these bureaus and present it in an easy-to-understand way. They often provide tools that can help you monitor your score, get personalized suggestions, and even simulate how certain actions might affect your credit. These platforms can be really helpful for getting a better grasp of your credit health and understanding the types of cards you might qualify for. So, when you are asking, "what credit card can I get?", these resources are excellent places to start your search and gather information.

Tools to Help You Move Forward

There are many tools and services available that are designed to give you personalized suggestions and ways of looking at your money. These can come from places like Intuit Credit Karma, and their main goal is to help you handle your money in a better way and perhaps even see it grow more quickly. They aim to help you get ahead in your financial life, which is a goal many people share. These tools can be quite good for understanding your current situation and planning for the future, in some respects.

These tools often provide insights based on your spending habits, your payment history, and your overall debt. They might show you where you can save money, or how to pay down existing debts more effectively. For instance, some tools can help you create a budget, or track your expenses, so you know exactly where your money is going. This kind of clear view can be really empowering, helping you feel more in control of your financial destiny, you know?

Accessing these personalized financial tools, such as those available on Credit.com, typically involves logging in securely. Once you are in, you can manage your credit information, keep an eye on your score, and use the various features offered. These features might include credit score simulators, which let you see how paying off a loan or opening a new account could impact your score. This foresight is incredibly valuable when you are weighing your options and trying to determine what credit card can I get that aligns with your financial aspirations. It is about making informed choices.

Ultimately, the journey to finding what credit card can I get is deeply tied to understanding your own financial picture. It involves knowing what credit is, how your past actions with money are recorded, and how to keep a watchful eye on your credit story. By using the free resources from companies like Experian, Equifax, and TransUnion, and taking advantage of tools from services like Intuit Credit Karma and Credit.com, you can gain a clear view of your financial standing. This knowledge empowers you to make thoughtful choices, helping you pick a credit card that truly supports your goals for managing and growing your money.

Related Resources:

Detail Author:

- Name : Miss Kellie O'Conner V

- Username : oebert

- Email : elinor39@bechtelar.com

- Birthdate : 2005-03-13

- Address : 721 Herzog Springs Dickinsonview, CT 05668-4582

- Phone : 989.335.1628

- Company : Hickle PLC

- Job : Arbitrator

- Bio : Dicta sint beatae numquam sapiente maxime harum sed. Ipsam quas aut voluptate.

Socials

linkedin:

- url : https://linkedin.com/in/dawnbosco

- username : dawnbosco

- bio : Ea laborum quasi in voluptate et.

- followers : 979

- following : 1313

tiktok:

- url : https://tiktok.com/@bosco1971

- username : bosco1971

- bio : Voluptatem pariatur quia ullam et eaque et.

- followers : 927

- following : 1244

facebook:

- url : https://facebook.com/bosco2022

- username : bosco2022

- bio : Ea officia ipsa error ut.

- followers : 3205

- following : 2980

instagram:

- url : https://instagram.com/dawn_bosco

- username : dawn_bosco

- bio : Consectetur aut voluptatum et optio reiciendis impedit ad. Et ipsam aut eum.

- followers : 3484

- following : 2061